In force - Superseded Version. Even if an item is allowed there might be some caveats.

Parcel Detained By Customs Sry Po No Fishy

A permit system ensures bona fide importers are paying the required excise tax.

Detained by customs due to tax permit mykula. The collection procedures for postal parcels is dependent on the type of goods and CIF value as shown in the table below. Letter to Customs to Release of Imported Goods. From 1 November 2021 recipients of items sent from overseas will be required to pay all duties andor GST due via the SingPost mobile app SAM kiosks or at any post offices before delivery is made.

How do I apply for a permit. Many wildlife and wildlife products are prohibited from import into the United States. 1st Dec the summon letter was dropped in the mailbox delivered 3rd Dec the parcel was released by customs.

Local customs departments do the executive work and draw the customs policies for each emirate in compliance with the GCC Common Customs Law PDF. And c the amendments of the A New Tax System Wine Equalisation Tax Act 1999 made by items 9 and 10 of Schedule 1 to the Customs Legislation Amendment Act No. Foreign nationals working in the Philippines are governed by at least three sets of rules those of taxation immigration and labor.

If your products have high commercial value like for example in the US items whose value is worth over 2500 you will require a customs broker will arrange for the taxes to be paid and for the shipment to be released from customs. Use the Border Watch Online Report for suspicious immigration customs and trade activity. The Sri Lanka Customs is dedicated to enforce revenue and social protection laws of the state while facilitating the trade with the objective of contributing to the national effort and in due recognition thereof.

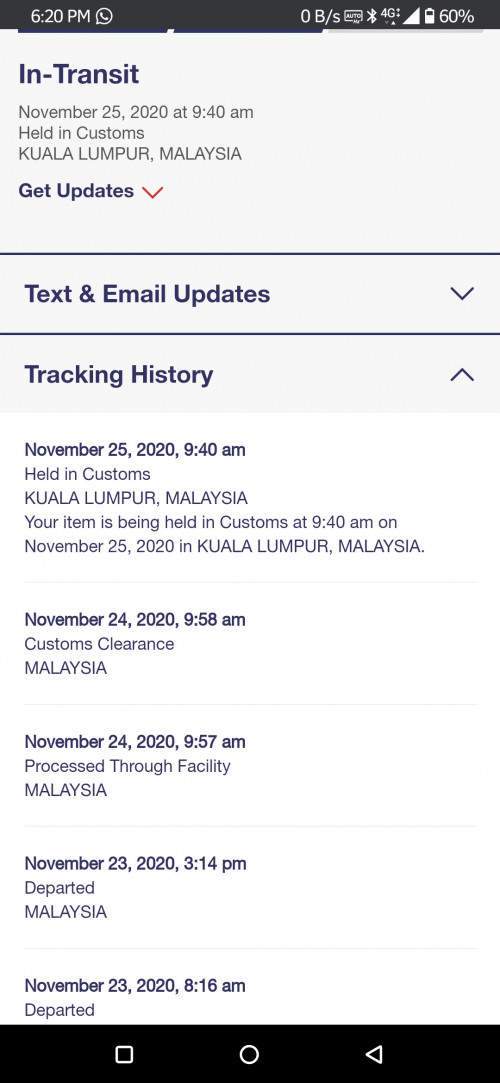

29th Nov the parcel retained by customs and they sent out the summon letter. This includes undertaking due diligence of imported products such as tobacco products tobacco leaf and refuse and tobacco importers manufacturers and retailers who import these products into New Zealand. Describe in your own words.

Taksiran duticukai dibuat atas JK78. Penerimaan bungkusan pos melalui laut dan darat yang bernilai melebihi RM 20000 CIF hendaklah diikrar dalam borang Kastam no 1. Suits The C -Suite.

Customs Act 1901. B the amendment of the A New Tax System Goods and Services Tax Act 1999 made by item 8 of Schedule 1 to the Customs Legislation Amendment Act No. Customs regulations and procedures see the Customs and Border Protection booklet Know Before You Go.

6 of 1901 as amended taking into account amendments up to Statute Law Revision Act 2013. Federal Customs Authority FCA draws the customs policies supervises the execution of customs-related laws and legislations and represents the UAE at home and abroad. Imported goods are subject to GST andor duty payment.

Ad Expert help auto-prefill accountants check your return no appointment needed. Where applicable Customs duty is levied on the transaction value of the goods the price actually paid or payable. Most couriers provide a tracking option on their websites to track your package.

You risk confiscation and a possible fine if you attempt to bring them into the United States. The due date for payment at least 14 days after we give notice. With all due respect I would like to inform you that I have completed all the customs formalities for bringing my goods from Country name to your country Name.

Immigration and Border Protection. Type your tracking code into the designated search field and hit. Value Added Tax VAT payable at the rate of 15 percent is then calculated on the duty-inclusive value.

This article focuses on taxation. Only by fully complying with each set of rules can foreign nationals ensure a fruitful and worry-free stay in the Philippines. Track the package via the courier service through which you are receiving it or sent it as US.

Use the tracking code you received when you shipped your package. An Act relating to the Customs. We would like to inform you that your parcel has arrived in Malaysia and is currently being held by customs due to high value goodsimport permit required subject to SST There are three 3 options available for customs clearance.

This compilation is affected by a. The reason for a shipment to Return to Origin RTO is due to the customer unable to provide the relevant permit to the Customs. Report a scam to SCAMWATCH Need further assistance.

Sri lanka Customs is one of the oldest government departments established in the year 1806 and is mainly. My goods were taken under custody last week Date from City name airport. So if I want to draw the timeline correctly this is how it should be.

We calculate penalties according to a statutory formula or in multiples of a penalty unit. Following are the items. If you use a standard express shipper or the postal service they will pay the tax for you DDU clearing your goods through customs.

The Customs charges applicable will vary according to the item being sent. Failure to meet your tax obligations may result in us imposing a penalty. All goods imported into Singapore are regulated under the Customs Act the Goods and Services Tax GST Act and the Regulation of Imports and Exports Act.

6851 d were initially codified as Section 250 g of the Revenue Act of 1921 and were enacted to thwart departing aliens from leaving the country with outstanding income tax liabilities. For more information see. Customs has no way to track packages.

The Code section laid the groundwork for what is commonly known as a sailing permit or departure permit. The rules of Sec. An Auckland businessman has been jailed for what has been described as unprecedented large-scale tax evasion after he and his company avoided 1873 million in state payments by smuggling nearly.

A customs permit is required to account for the import and tax payment of the goods. If you have a question about. Besides when a customer disagrees with HS code amended by customs and request for appointment with customs and the appeal is rejected customer will need to pay the duty and tax amount as indicated by the customs.

Bagi barang yang bernilai kurang RM 20000. You cant claim a deduction for penalties we impose. We calculate the penalty amount using either.

Calculation of Customs Charges. Some of them are allowed some are not and some require you to get a permit before bringing them in. For information on US.

28th Nov the parcel retained by customs.

My Cheapkpoporder On Twitter Some Of My Latest Group Order Proof Receipt 1 Week Can Arrive If Detained By Customs 1 Week Can Release Faster If I Go Collect Myself