Quickly Apply Online Now. The fee for renewal is as follows.

How To Register For A Sales Tax Permit In Pennsylvania Taxvalet

Note that it is unlawful to make taxable sales to Pennsylvania customers without being licensed.

Pa sales tax license permit. How to Apply for a Pennsylvania Sales Tax License You can apply online using PA Enterprise Registration Form PA-100 and supplying information about your business such as. REV-1176 -- e-TIDES Administrative Access Change Request Form. For sales on Etsy you need to do nothing.

There currently is no charge to. 800 524-1620 Pennsylvania Sales Tax Application. The Online PA-100 may be used to register a new business entity add additional taxes or services or to register a new business entity that is acquiring all or part of an existing business entity.

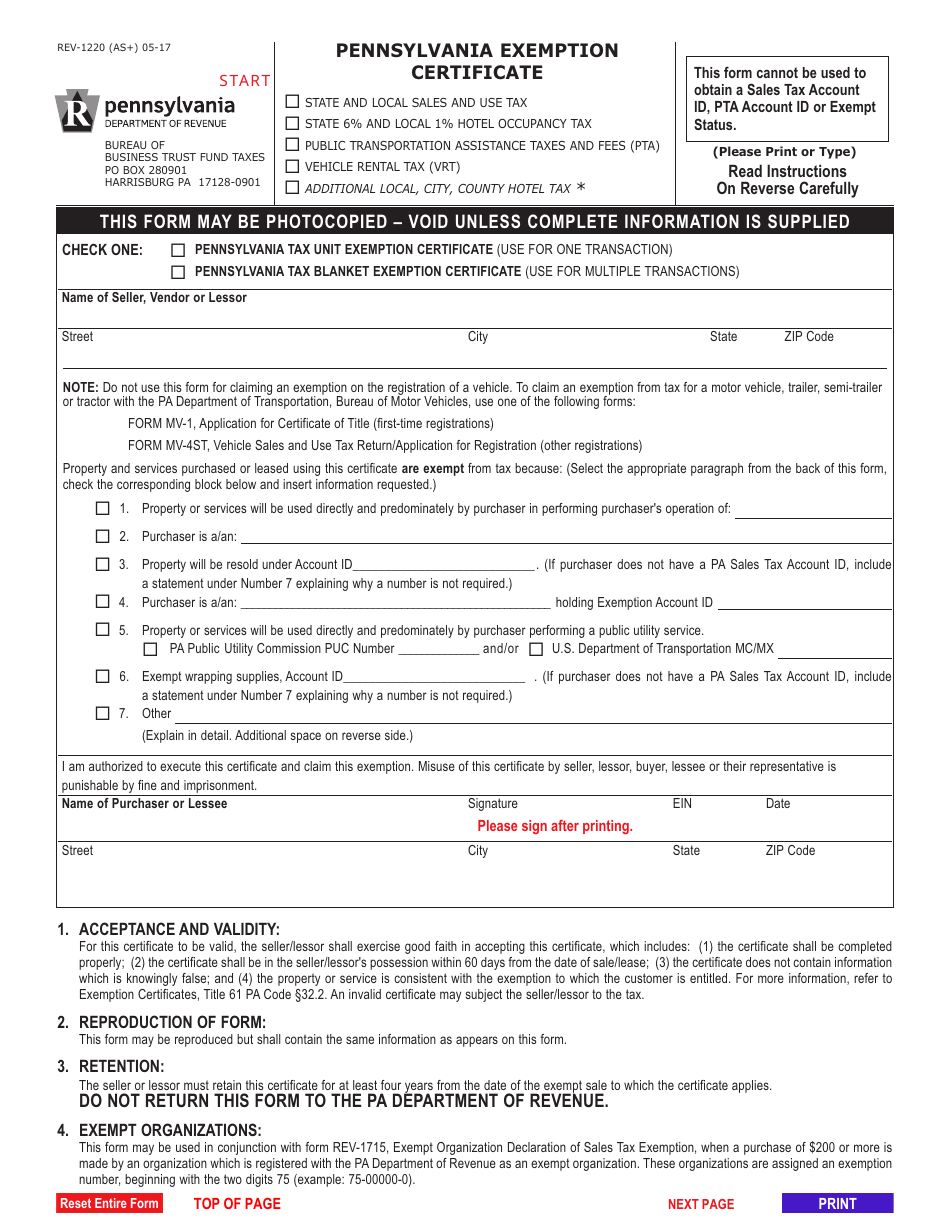

A PA Sales License has tremendous benefits. REV-1220 -- Pennsylvania Exemption Certificate. All businesses selling products and services subject to sales tax in.

REV-1605 -- Names of Corporate Officers Coupon and Instructions. Eight-digit Sales Tax Account ID Number. A resale certificate allows a.

Required for any business in PA selling tangible goods. Qualify for wholesale discount pricing. In obtaining a sales tax permit a seller agrees to act as an agent for the state for the collection and remittance of sales tax as prescribed by law.

This is commonly referred to as a sellers permit sales tax permit sales tax number or sales tax registration. The best way to get a duplicate Sales Tax License or other Revenue license s is to obtain a copy in the e-TIDES Document Center. Provide basic information about your name phone number and.

After you register you will receive your licenses andor registration notices in the mail in 7 to 10. Signage Permit Some municipalities require a permit before adding signage. Ad We process your resale certificate application within 5 business days.

The sales tax license is obtained through the Pennsylvania. Nine-digit Federal Employer Identification Number or Social Security number or. Etsy is currently collecting and remitting PA sales tax.

Depending on the type of business where youre doing business and other specific. A Pennsylvania Sales Tax Permit can only be obtained through an authorized government agency. New State Sales Tax Registration.

09-27-2018 0429 AM. If you choose to expedite your application you will receive it in 2 business days. Obtaining your sales tax certificate allows you to do so.

Opens In A New Window. Pennsylvania offers a sales tax permit but they call it a Sales Use Hotel and Occupancy Tax Permit Very comprehensive wouldnt you say. Pennsylvania Sales Use Hotel Occupancy Tax License Application Fee Turnaround Time and Renewal Info You will need to pay an application fee when you apply for a Pennsylvania Sales.

Unless you sell off Etsy you wont need to collect or. Ad Apply For Your Pennsylvania Retail License. You can go the traditional route and apply directly to the Pennsylvania Department of Revenue.

Both job-seekers and employers must overcome significant barriers for Pennsylvania to close. There are two different options for obtaining your sales tax permit in Pennsylvania. A Pennsylvania resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to.

To obtain a sellers permit you must file Pennsylvania Enterprise Registration Form PA-100 which may be submitted either online or by printing out the form and mailing it. Get Your Pennsylvania Retail License for Only 6995. How long does it take to receive your Pennsylvania sales tax permit.

In Pennsylvania this sellers permit lets your business buy goods or materials rent property and sell products or services tax free. The following is what you will need to use TeleFile for salesuse tax. There are currently more job openings than there are available workers to fill them.

Avoid paying sales tax on purchases. Your correspondence will be available for. Opens In A New Window.

Ad Pennsylvania Sales Tax Permit information registration support. Ad Pennsylvania Sales Tax Permit information registration support. You need to get a sales tax permit in Pennsylvania if you have a physical presence or meet economic affiliate or click-through nexus as determined by the.

New State Sales Tax Registration. Complete in Just 3 Steps. How to Renew Your Broker Company License.

Associate Broker - Standard and Reciprocal. Download Pennsylvania Sales and Use Tax Resale Certificate from the Department of Revenue site. To register for a sales tax license go to httpswwwpa100statepaus.