Sales Use Tax in California. State tax rate local tax rate county rate and any district tax rate that may be in effect.

Setting Up Sales Tax In Quickbooks Online

Where to Go If You Need Help Registering for.

Sales tax permit cost california. We have all the rules and requirements for obtaining this. Unladen Weight Permit REG 4030 30. There are two ways to submit sales tax to the.

Ad Get started apply for your California Sellers Permit. Sales tax in California varies by location but the statewide vehicle tax is 725. The local government cities and districts.

Retailers engaged in business in California must register with the California Department of Tax and Fee Administration CDTFA and pay the states sales tax which applies to all retail sales. 4010 Calculating Use Tax Amount. You need to get a sales tax permit in California if you have a physical presence meet economic nexus requirements have an affiliate in California or attend.

No California does not require you to renew your sales tax permit. Most retailers even occasional sellers of tangible goods are required to register to collect sales or use tax. The statewide tax rate is 725.

California Fuel Tax Trip Permit BOE 123 30. If you are doing business in California and intend to sell or lease tangible personal. There is no fee to register for a Sellers Permit with the state of California.

At LicenseSuite we offer affordable Los. Register for a Permit License or Account. In California this sellers permit lets your business buy goods or materials rent property and sell products or services tax free.

4015 Credit for Tax Paid to Another State. As a retailer in. This is commonly referred to as a sales and use tax permit sales tax license sales tax number or sales tax registration.

There is no cost to apply for a permit. Foreign Resident In-transit Permit VC 67001 CRTC 63662 60. If you do not hold a sellers permit and will make sales during temporary periods such as Christmas tree sales and rummage sales you must apply for a temporary sellers.

Retailers engaged in business in California must register with the California Department of Tax and Fee Administration CDTFA and pay the states sales tax which applies to all retail sales. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. In California the credential you must acquire in order to legally do business in the state and collect sales tax is called a California Sellers Permit.

Those district tax rates range from 010 to. The California Department of Tax and Fee Administration administers many tax and fee programs. There is no charge for a sellers permit but security deposits are sometimes required.

Verify a Permit License or Account. The issuance of a One Trip. How much does it cost to apply for a sales tax permit in California.

Fast easy and secure filing. You can apply online using online registration or you may apply at a nearby CDTFA location. 4005 California Department of Tax and Fee Administration Review Request.

Generally if you make three or more sales of items subject to California sales and use tax in a 12-month period you are required to register for a California sellers permit and pay tax on your. Skip the lines apply online today. However there may be a security deposit if you have unpaid taxes if.

Arizona charges 12 for each business location. Free but there may be a security deposit if your taxable sales are high enough. Request an Extension or Relief.

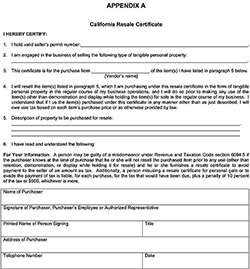

Of the 725 125 goes to the county government. State Local and District Sales and Use Tax Return CDTFA-401 PDF General Resale Certificate CDTFA-230 PDF Guides. Californias sales tax permitting system.

Your California Sellers Permit. Complete in just 3 easy steps. How much does a sales tax permit in California cost.

The cost of a Los Angeles County California Sales Tax Permit depends on a companys industry geographic service regions and possibly other factors. The sales and use tax rate in a specific California location is comprised of four parts. Alabama does not charge a fee to register for a sales tax permit and does not require a security deposit.

The sales and use tax rate is not the same in all California locations. While the standard statewide rate is currently 725 percent the total sales and use tax rate is higher in. A Sellers Permit is issued to business owners and allows them to.

51 rows The license is free for out-of-state sellers who make taxable retail. Fee Type Fee Amount.

California State Sales Tax 2018 What You Need To Know Taxjar