Do I need a Federal Tax ID Number or EIN to register for A Hawaii sales tax permit. If any of these links are broken or you cant find the form.

Inspirational Free Sales Receipt Template Pdf Best Of Template Within Car Sales Invoice Template Free Downl Cars For Sale Invoice Template Word Invoice Example

You need that to buy wholesale sell retail or sell wholesale as well as to lease tangible goods.

Hawaii sales tax permit. You are allowed to cancel your sales tax permit in Hawaii. Ad Apply For Your Hawaii Sales Tax License. Complete in Just 3 Steps.

Hawaii keeps it reasonable and only charges 20 for a GET permit. While technically Hawaii does not have a sales tax there is a 4 percent general excise. At the present time Hawaii allows for you to cancel your sales tax permit if you no longer use or need it.

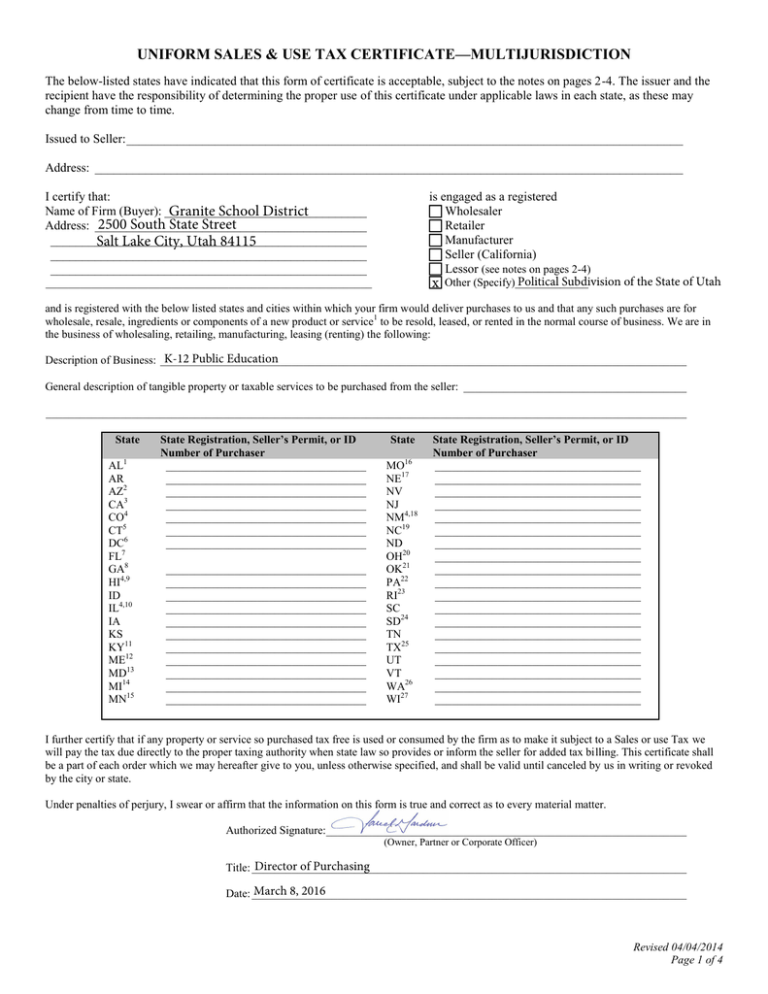

Hawaii Sales Tax General Information on State Sales Tax Resellers Permit Tax Certificates Business Registration Wholesale License Virtually every type of business must obtain a type of. Sales Tax Registration SSTRS Registration FAQ. The tax rate is 015 for Insurance Commission 05 for Wholesaling.

State Registration for Sales and Use Tax. Instead we have the GET which is assessed on all business activities. In Hawaii this sellers permit lets your business buy goods or materials rent property and sell products or services tax free.

Ad Simplify the sales tax registration process with help from Avalara. Obtaining your sales tax certificate allows you to do so. Fill out one form choose your states let Avalara take care of sales tax registration.

Where to Register for a. Option 1 recommended. 335 Merchant Street Room 201 Honolulu HI.

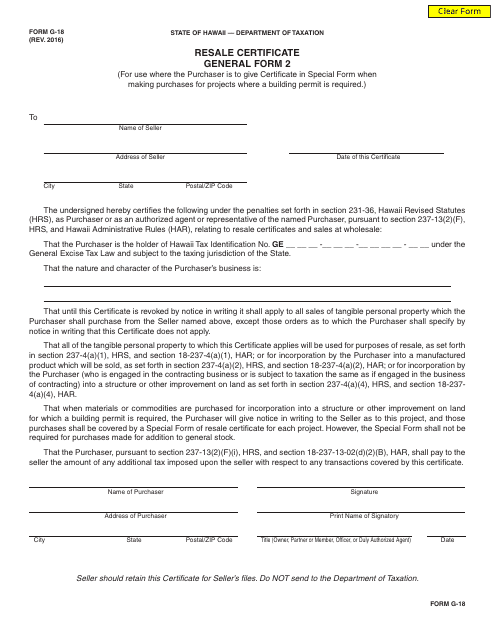

Counties and cities can charge an additional local sales tax of up to 05 for a maximum. Department of Commerce and Consumer Affairs. That the Purchaser pursuant to section 237-132Fi HRS and section 18-237-13-02d2B Hawaii Administrative Rules shall pay to the seller the amount of any additional tax imposed.

Avoid The Hassle and Order Your Sellers Permit Online Hassle-Free. Printable Hawaii Exemption Certificates. In Hawaii most businesses are required to have a sales tax permit.

A HI Sales Tax ID Number 39 Also Called a Sellers Permit Wholesale ID Resale Reseller ID. Ad Fill out a simple online application now and receive yours in under 5 days. If you are registered to collect sales tax in Hawaii ie.

Other Hawaii business registration fees may apply depending. Hawaii Administrative Rules section 18-231-3-1417 enables the Department of Taxation Department to revoke tax licenses due to abandonment. Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services.

Fill out one form choose your states let Avalara take care of sales tax registration. 11 rows Licensing Information. Businesses operating in Hawaii are required to.

This section applies to businesses that are applying for a license in Hawaii for the first time. Hawaii Basic Business Application. Ad Simplify the sales tax registration process with help from Avalara.

Step 1 Begin by downloading the Hawaii Certificate of Resale Form G-17 Step 2 Identify the name and of the seller Step 3 Enter the date the certificate was prepared Step 4. We have two Hawaii sales tax exemption forms available for you to print or save as a PDF file. It costs 20 to apply for a Hawaii GET permit.

Hawaii does not have a sales tax. State Contacts 808 587-4242. How to Register on HTO PDF 1page 179 KB.

When applying for the General ExciseUse Permit the state charges a flat license fee of 2000. This means that if you are considering opening a new business or are beginning to make sales in Hawaii for the first time. You have an active Hawaii sales tax permit then the state still requires that you file sales tax returns.

The Hawaii state sales tax rate is 4 and the average HI sales tax after local surtaxes is 435. How Much Does a Sales Tax Permit in Hawaii Cost. Register as a Third Party on Hawaii Tax Online.

Hawaii Department of Taxation. How much does it cost to apply for a sales tax permit in Hawaii. Use Hawaii Business Express to file a single application to register a new business with the Department of Commerce and Consumer Affairs DCCA and apply for various types of tax.

Sales Use Tax Licensure. If you dont already. If you only make.

Ad Fill out a simple online application now and receive yours in under 5 days. Register create an online account at the same time.