Wisconsin Sales Tax Number GuRetail Trade homemade items in Antioch Lake County IL. If you have quetions about the.

Tax Exempt Form Attach Here Fund Raising Candy Bars Vande Walle S Candies

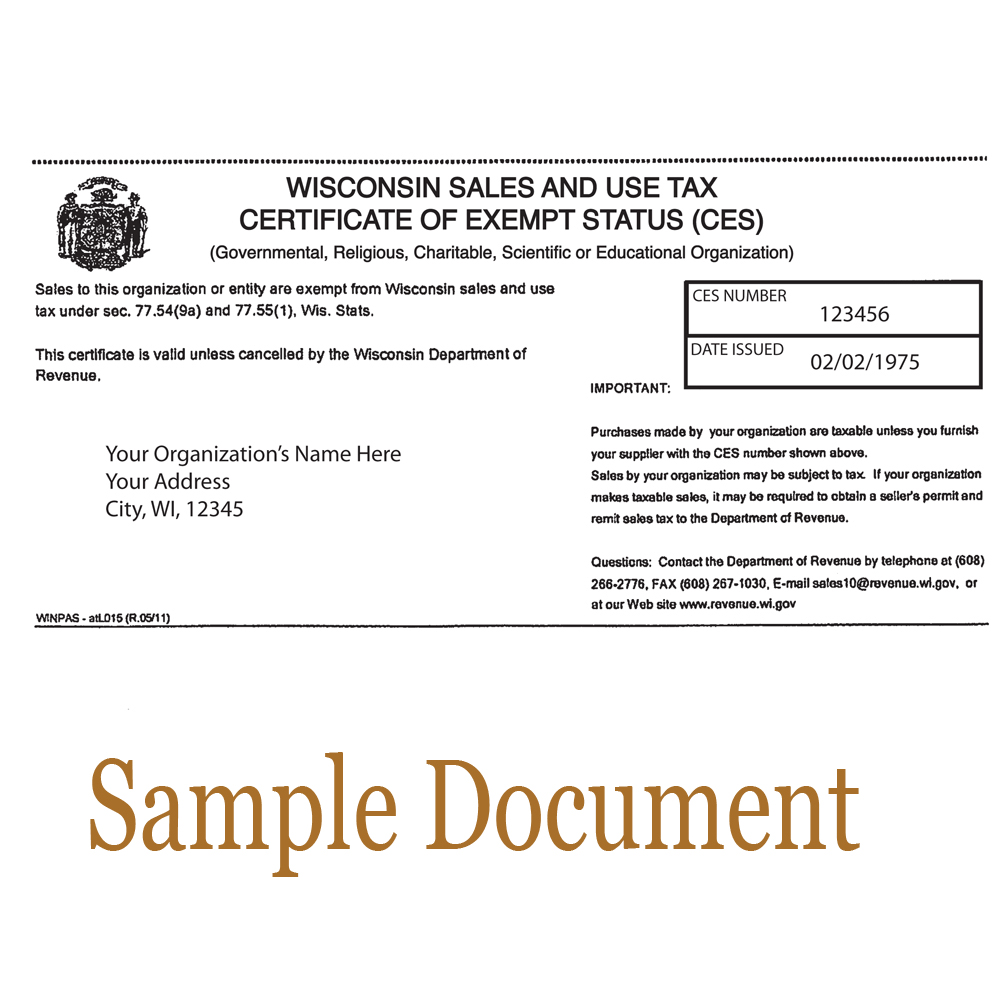

A sellers permit is commonly known as a sales tax permit reseller permit resale certificate sales tax exemption certificate sales tax license or sales and use tax permit.

Wi sales tax seller's permit. Your business entity type is a. This permit will furnish a business with a unique Sales Tax Number otherwise referred to as a Sales Tax ID Number. Additional Sales Location for Sellers Permit.

Quickly Apply Online Now. Register with Department of Revenue if any of the following apply. In Wyoming this sellers permit lets your business buy goods or materials rent property and sell products or services tax free.

In addition to the sellers permit. Once you have that you are eligible to issue a resale certificate. Less than 2000 in sales of taxable products or services in a year and the seller does not hold and is not required to hold a sellers permit.

How Much Does a Sales Tax Permit in Wisconsin Cost. Form ST-12 - Sales and Use Tax Return. Ad Get Your Sellers Permit for Only 6995.

Your start date mm dd yyyy Enter your. Most California cities and counties Sales Tax get Sellers Permit rate is 75 but some cities like Alhambra has a higher rate of 95 STATESTATE RATERANGE OF LOCAL RATESLOCAL. In the state of.

The sellers permit is obtained through the Wisconsin Department of Revenue as a part of applying for the Wisconsin Business Tax Registration. A sellers permit is issued. Non-Wisconsin LLC or corporation.

A seller is presumed to not be pursuing a vocation. WI Sales Tax Permit GuServices Lawn Service in Fontana Walworth County WI. Get Your Wisconsin Sellers Permit Online.

A sellers permit is required for all event sellers of taxable merchandise or property in Wisconsin unless sales are exempt from sales or use tax. Depending on local municipalities the total tax rate can be as high as 56. Other local-level tax rates in the state.

Sellers Permit Or Sales Tax GuConstruction Sales in Waupaca Waupaca County WI. A sellers permit re-seller permit is required for every individual partnership corporation or other organization making retail sales leases or rentals of tangible personal property or. Schedule P Attachment to Form BCR Buyers Claim for Refund of Wisconsin State County and Stadium Sales Taxes.

Click Here to Get Your Sellers Permit Online. TeleFile Worksheet and Payment Voucher. Click Here to Get Your Sellers Permit Online.

Form S-211 - Sales and Use Tax Exemption Certificate. Wi Sales Tax GuServices landscape contractor in River Falls Pierce County WI. State of Wisconsin filing fee is 2000 to issue a sellers permit.

Complete in Just 3 Steps. 10493 Wi Sales Tax. Wisconsin department of revenue does not allow to.

You can easily acquire your Wisconsin Sellers Permit online using the Wisconsin Business Tax Registration website. State of Wisconsin sends an original sales tax certificate in the mail. Ad Fill Sign Email BTR-101 More Fillable Forms Register and Subscribe Now.

The Sellers Permit allows a business to sell and collect sales tax from taxable products and services in the state while the Resale Certificate allows the retailer to make tax. Wisconsin currently charges a 20 registration fee to apply for the Sellers Permit. Apply For Your Sellers Permit.

Where to Register for a. Form BTR-101 - Application for. The Wisconsin WI state Sales Tax get Sellers Permit rate is currently 5.

Wisconsin Department of Revenue. Other local-level tax rates i. A Wisconsin Sellers Permit is required for individuals partnerships corporations or other organizations to make wholesale or retail sales or rentals of tangible personal property or retail.

Depending on local municipalities the total tax rate can be as high as 56. Obtaining your sales tax certificate allows you to do so. Click Here to Get Your Sellers Permit Online.

The Wisconsin WI state Sales Tax get Sellers Permit rate is currently 5.