Get your Wisconsin Sellers Permit and Resale Number in 24 hours. Wisconsin currently charges a 20 registration fee to apply for the Sellers Permit.

Free Wisconsin Motor Vehicle Bill Of Sale Pdf Eforms

Ad Wisconsin Sales Tax Permit Application Wholesale License Reseller Permit Businesses Registration.

Wisconsin sales tax permit. The license is free for out-of-state sellers who make taxable retail sales in the state. The cost to register for an Oklahoma sales tax permit is currently 20. A sellers permit is required for every individual partnership corporation or other organization making retail sales leases or rentals of tangible personal property or taxable.

State of Wisconsin filing fee is 2000 to issue a sellers permit. Sales and Use Tax License Sales tax permits are mandatory for most businesses in Wisconsin. In Wisconsin most businesses are required to have a sales tax permit.

The Sellers Permit allows a business to sell and collect sales tax from taxable products and services in the state while the Resale Certificate allows the retailer to make tax. This will include all online. It is also possible for sales tax payment to be remitted through this online system.

Wisconsin - Apply now for a Sales Tax License Resale Certificate Sellers Permit Wisconsin coming soon Why Your Business Needs a Wyoming Sellers Permit Also known as. Complete in Just 3 Steps. New businesses or if it one is initiating sales for the first time within the state of.

Wisconsins state-wide sales tax rate is 5 at the time of this articles writing but local taxes bring the effective rate from 55 to 56 depending on location. In addition to the sellers permit. Form ST-12 - Sales and Use Tax Return.

A sellers permit is commonly known as a sales tax permit reseller permit resale certificate sales tax exemption certificate sales tax license or sales and use tax permit. This means that if you are considering opening a new business or are beginning to make sales in Wisconsin for the first. Ad Get Your Sellers Permit for Only 6995.

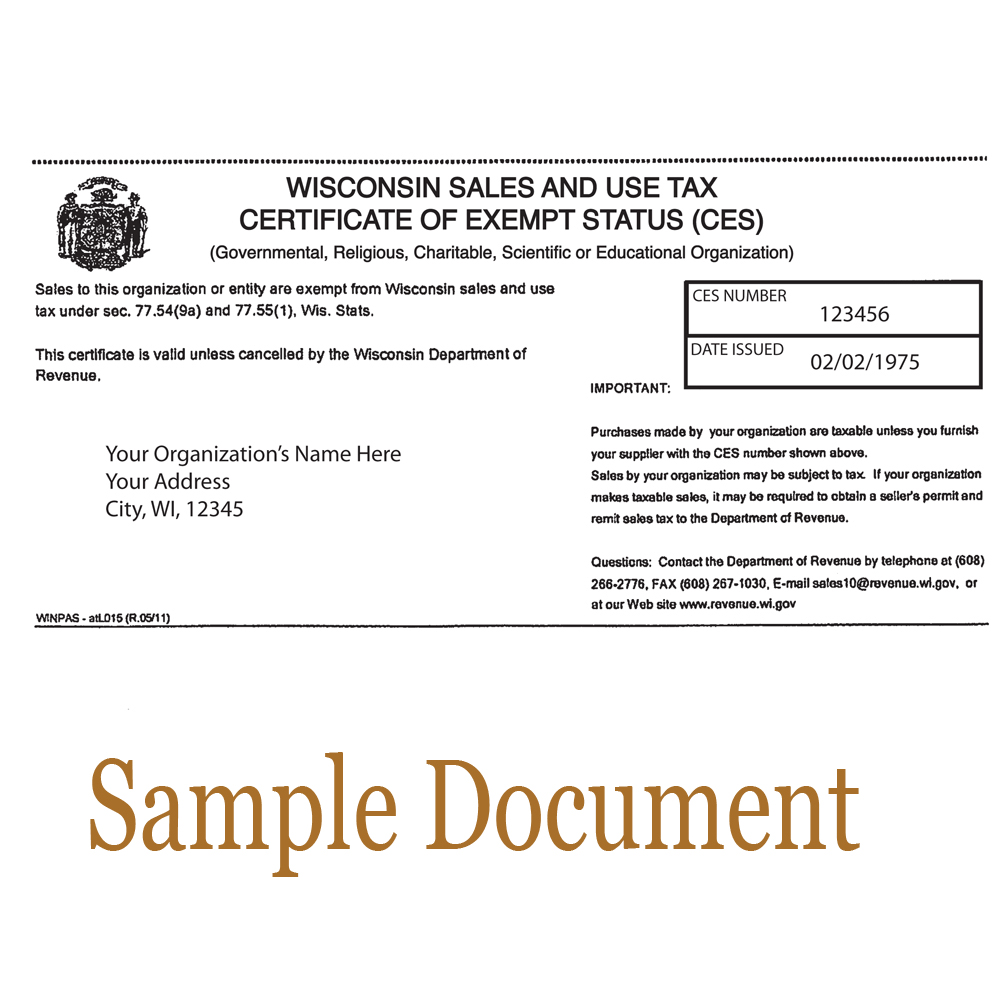

Depending on the type of business where youre doing business and other specific regulations. Schedule P Attachment to Form BCR Buyers Claim for Refund of Wisconsin State County and Stadium Sales Taxes. A Wisconsin Sales Tax Permit can only be obtained through an authorized government agency.

State of Wisconsin sends an original sales tax certificate in the mail. County Sales and Use Tax. A sellers permit is required for all event sellers of taxable merchandise or property in Wisconsin unless sales are exempt from sales or use tax.

Wisconsin Sales Tax Permit Application Simple Online Application. Ad Wisconsin Sales Tax Permit Application Wholesale License Reseller Permit Businesses Registration. In order to have a Wisconsin resale certificate you must first apply for a Wisconsin sales tax permit.

One way this can be accomplished is by filing online at the Wisconsin Department of Revenue. Complete this application for a Wisconsin tax permit. Quickly Apply Online Now.

A sellers permit is issued for a. Allow 15 business days. Where to Register for a Wisconsin Sales Tax Permit There are two ways to register for a Sellers.

TeleFile Worksheet and Payment Voucher. This permit will provide you with a Wisconsin Tax ID number sales tax number which. In the state of.

Any business that sells goods or taxable services within the state of Wisconsin to customers located in Wisconsin is required to collect sales tax from that buyer. 42 rows s-220a. The sellers permit is obtained through the Wisconsin Department of Revenue as a part of applying for the Wisconsin Business Tax Registration.

Wisconsin Business Tax Registration Apply online at taprevenuewigovbtr. We advise you to check out the. Municipal governments in Wisconsin are also allowed to collect a local-option sales tax that ranges from 0 to 175 across the state with an average local tax of 0481 for a total of.

Apply Over The Phone at 608-620-3361 Wisconsin. Difference Between Sales Tax and Use Tax. Find Wisconsin State County and Stadium Sales Tax Rate.

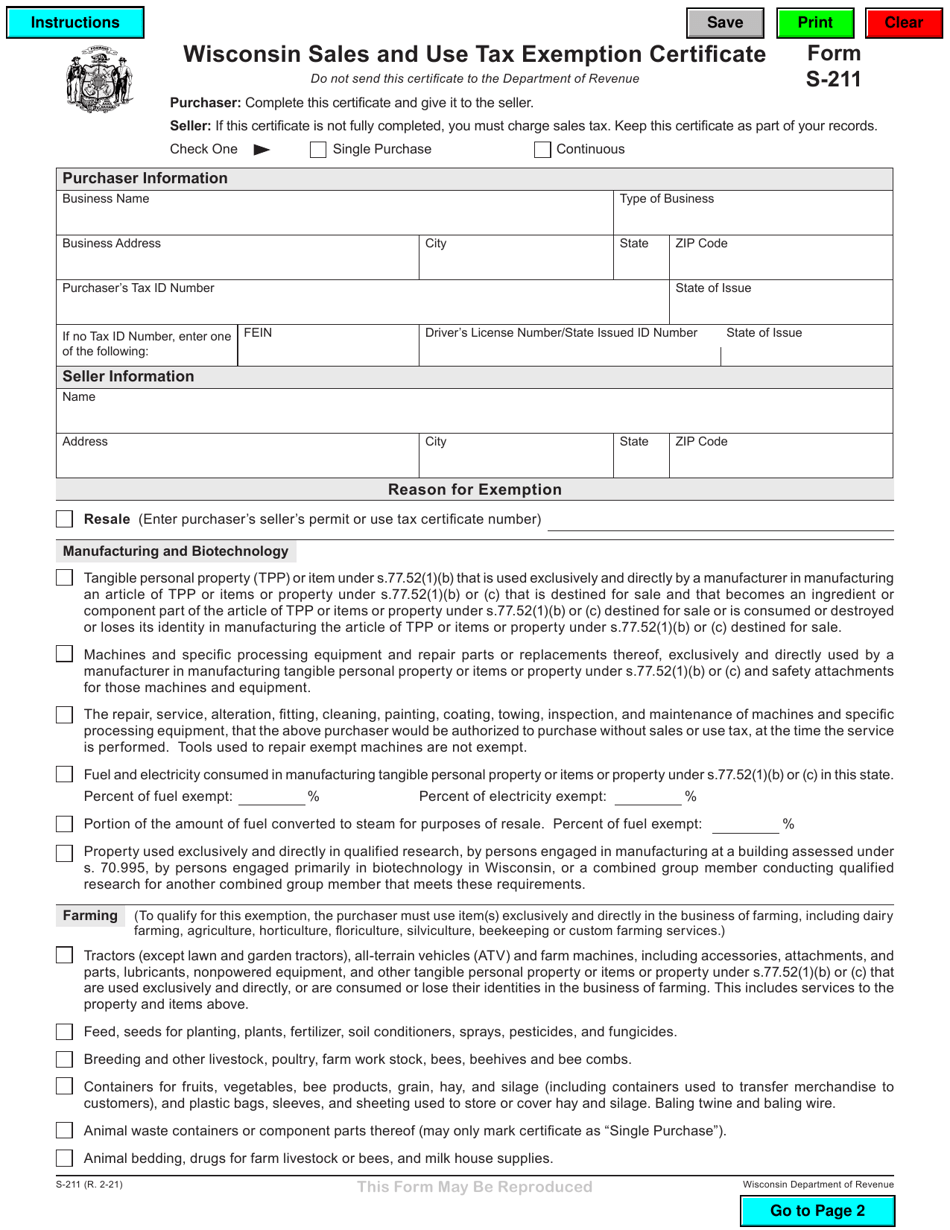

Wisconsin DOR My Tax Account allows taxpayers to register tax accounts file taxes make payments check refund statuses search for unclaimed property and manage audits. Apply For Your Sellers Permit. Form S-211 - Sales and Use Tax Exemption Certificate.

Form BTR-101 - Application for. Wisconsin Sales Tax Permit Application Simple Online Application. Wisconsin department of revenue does not allow to transfer.

Tax Exempt Form Attach Here Fund Raising Candy Bars Vande Walle S Candies

Fillable Form Wisconsin State Id Application Mv3004 Wisconsin State Wisconsin Application